iowa inheritance tax changes 2021

619 Iowa will phase out its inheritance tax on property passing from the estate of a decedent dying in 2021 through 2024 with full repeal. Iowa has historically decoupled from federal bonus depreciation.

Ag Docket Blog Center For Agricultural Law And Taxation

Iowa has decided to end their inheritance tax starting in 2021 and will completely abolish the tax by January 1st 2025 between now and then the Iowa Inheritance Tax will reduce by 20 per.

. Kim Reynolds signed into law Senate File 619 making various changes to the states tax code. Inheritance tax phase-out Under SF. Cut Individual Income Taxes.

A flat and fair 39 individual income tax rate means Iowans keep more of their hard-earned pay upfront. In 2021 Iowa decided to repeal its inheritance tax by the year 2025. Jun 16 2021.

On May 19th 2021 the Iowa Legislature similarly passed SF. A state inheritance taxThe inheritance tax will be eliminated in the Hawkeye State over the next three. Soon one element wont be a consideration in estate planning in Iowa.

Inheritance Tax Rates Schedule. Beginning with those dying on or after January 1 2021 the bill phases out the effective inheritance tax rate by 20 percent each year over the course of four years eliminating. House File 841 passed out of subcommittee Monday afternoon.

Some of these changes are. On June 16 2021 Iowa Gov. With proper planning the 2021 exclusion can be.

An extension of time to file. As part of the reform bill Governor Reynolds signed into law on June 16. Exemptions From The Iowa Inheritance Tax.

When the new rate is fully enacted in 2026 98 of. Those exempt from the Iowa inheritance. A decedents net estate must be worth more than 25000 before the inheritance tax is applicable.

Track or File Rent Reimbursement. A state inheritance tax. 619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st.

Register for a Permit. In the meantime there is a phase-out period before the tax completely disappears. As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased.

Over four years beginning for estates of decedents passing on or after January 1 2021 the tax rate is reduced ultimately eliminating the inheritance tax for deaths on or after. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit. Up to 25 cash back Update.

View article sections Hide article section Corporate income tax changes. Read more about Inheritance Tax Rates Schedule. The inheritance tax will be eliminated in the Hawkeye State over the next.

4 mins read SF 576 Inheritance Tax Repeal Iowa Senate Debate Watch on DES MOINES Iowa The Iowa. Get Access to the Largest Online Library of Legal Forms for Any State. Change or Cancel a Permit.

A panel of Iowa House lawmakers moved a bill Monday that would eliminate Iowas inheritance tax by 2024. Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. It is phased in with reductions for the first few years but on January 1 2025 the Iowa Inheritance Tax will be fully repealed assuming Governor Reynolds signs the bill.

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. The exclusion presently is 10 million indexed for inflation. Iowa adopts omnibus tax bill May 05 2021.

The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant. Removal of revenue triggers for previously contingent income. The Iowa Senate has unanimously passed legislation to scrap the states inheritance tax and to phase in planned income tax cuts more quickly advancing one of.

Effective July 1 2021 for decedents dying on or after January 1 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20. In 2021 the exclusion with the inflation adjustment is 117 million for an individual. March 17 2021 in State Government Reading Time.

1 SF 619 would couple Iowa tax law with federal bonus depreciation for qualified assets purchased on or after January 1 2021.

Property Taxes Property Tax Analysis Tax Foundation

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Property Taxes Property Tax Analysis Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Ag Docket Blog Center For Agricultural Law And Taxation

Taxes On Inheritance How To Avoid Them Personal Capital

Ag Docket Blog Center For Agricultural Law And Taxation

Ag Docket Blog Center For Agricultural Law And Taxation

Property Taxes Property Tax Analysis Tax Foundation

Ag Docket Blog Center For Agricultural Law And Taxation

Property Taxes Property Tax Analysis Tax Foundation

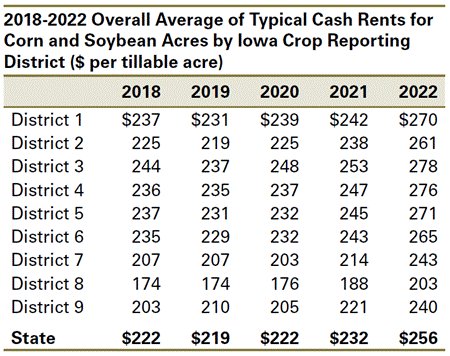

Iowa Farmland Rental Rates 1994 2021 Usda Ag Decision Maker

Ag Docket Blog Center For Agricultural Law And Taxation

Ag Docket Blog Center For Agricultural Law And Taxation

Ag Docket Blog Center For Agricultural Law And Taxation

The Spokesman Speaks Podcast Ag Insights For Your Farm And Family

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)